The Application of Cloud Computing in Banking

Today, the banking sector is adapting to the fast-growing digital world to attract and satisfy more customers. Banks use cloud apps for proper data management. Through data analysis, they can deliver adequate customer service at lower costs.

Expect banks to be using cloud apps in the future to gain more customers and profits. This article will focus on how banks use cloud computing, the benefits that banks get from it, and how cloud banking systems are the future of financial services.

How Cloud Computing is used in Banks

Financial institutions use cloud computing for various purposes. Please take a look at them.

● Security

Most banks use cloud technology to detect cyber-attack issues. It happens through analyzing data and noting any abnormalities or risks before they cause further damage.

● Data Management

Big data is easy to keep and analyze using cloud apps. Proper data handling allows banks to create ways to suit customer needs and run the bank.

● Customer Relationship Management (CRM)

Banks use cloud apps to manage the CRM systems that handle customer data and interactions. So, it helps them track customer activities wherever and whenever they aim to satisfy them.

Benefits of Using Cloud Technologies in the Banking Sector

Here are the benefits that banking institutions get from cloud computing technology.

1. It’s a Flexible Technology

The cloud in banking allows for faster and easier data access. Also, banks can scale up or down at any time as they aim to serve customers.

2. Cloud Technology Lower Costs

Banks that use cloud technology apps to store data tend to save more money. Most of them use pay-as-you-go cloud apps. It’s a cheap technology for banking institutions.

3. Cloud is Fast

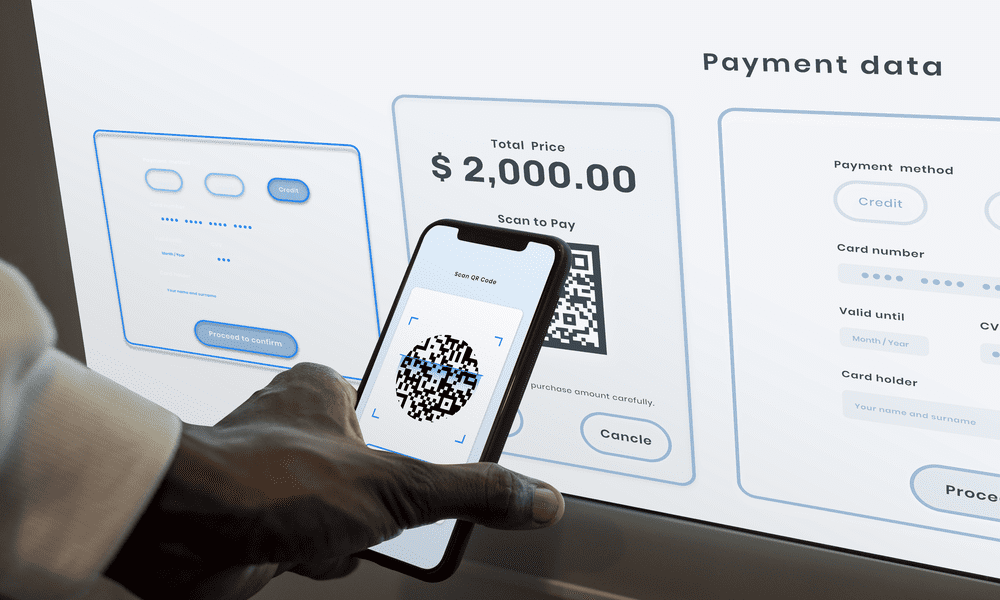

Expect fast data processing speeds if you have the proper cloud app that suits your needs. It allows banks to serve their customers with fast transaction speeds.

4. Promotes Creativity and Enhancements

Cloud apps give room for new ideas that banks can implement. So, your bank can go for the apps' enhancements and see if they'll work for them.

5. Easy Risk Management

Since cloud technology has faster and more reliable data processing power, it gives managers an easy time. Banks can analyze big data and design new and important insights. Also, the cloud comes with automation to assist in proper risk management.

6. Open Banking

Your customers will allow secure third parties to access their data using an API. Here, users will have a better and more customized customer experience: open banking. But cloud app service providers need to connect with banks because of the big data.

7. Improves Customer Experience

Cloud technology allows banks to rely on Artificial Intelligence (AI) and chatbots to serve customers. These institutions use AI to enable deeper privacy and curb cyber insecurity issues. It makes customers trust the banks more to handle their data and money.

Cloud Banking Systems for the Future of Financial Services

As technology keeps advancing, we expect cloud computing to be the future of the financial sector. Expect the financial cloud services market value to grow by 2028.

Most financial institutions today view cloud technology as the new normal. Big data keeps growing, pressure for proper banking management rises, and competition is becoming stiffer. So, expect cloud computing technology to have those who embrace it and those who don't. Those banks that won't invest in cloud computing will have fewer customers in the future.

The best way banks will become great in the coming days is by embracing cloud computing. It helps financial institutions handle their data well, mitigate possible risks, and better suit customer needs.